Customers

Bank Mandiri: Consistent Messaging Builds Trust that Boosts Conversions

November 30, 2022

Their Story: Indonesia’s leader in digital banking services

Indonesia’s largest bank, Bank Mandiri, prides itself on being a market leader in digital innovation.

Always looking for ways to streamline its digital offers, Bank Mandiri set its sights on making it easier for credit card customers to request payment plans and apply for new cards.

With more than 1.5 million credit card customers across the country, Bank Mandiri needed a reliable and versatile partner to take customer engagement to new heights. They chose WhatsApp to help them achieve their goals.

The Goal: Automate processes to increase conversions without burdening live agents

Bank Mandiri needed a better communication channel—one that could effectively explain the required next steps to customers and free up support agents to tackle more complex matters.

All Bank Mandiri customers who make transactions over a set amount receive an offer to convert their purchase transactions into convenient installment plans. However, to request a payment installment plan, Bank Mandiri’s customers must first verify every one of their transactions.

Before partnering with WhatsApp, the bank sent text messages with URL links to verify every transaction. But SMS messages have a 160-character limit, not nearly enough to clearly explain to customers what they need to do and why. This led to customers calling the bank en masse to speak to an agent in order to confirm the required transaction details.

The process for verifying credit card applications was similarly daunting. The URL links sent to customers once again exceeded the character limit and weren’t able to include proper instructions. Unsure of how to proceed, customers called the bank’s already-busy customer support centers to request instructions on what to do next.

Bank Mandiri needed a solution to make its communications trustworthy and clearer so that customers understood exactly how to verify purchases and create an installment plan.

The Solution: Clear and effective communication via WhatsApp

The decision to go with WhatsApp Business Platform was easy, given that WhatsApp is one of the most popular messaging applications in Indonesia, with roughly 78.5 million users in 2021, according to Statista.

The bank also tapped WhatsApp partner Damcorp for the project. The goal was to drive business growth by re-engaging existing credit card customers through the WhatsApp Business Platform.

The first step was gaining the trust of customers who were eligible for installment payment plans. To do that, Bank Mandiri injected familiarity into its messaging. Known to Indonesian consumers as “the magic number,” the bank started to include their instantly recognizable 14000 customer service line in communications.

With the addition of a number that was well known to their customers, messaging became familiar and communication more convenient. Through WhatsApp, customers could now receive more detailed information about the installment plans and how to access them via URL.

It also became easier for customers to access support agents, if necessary, via a direct response through WhatsApp messaging or by tapping on the 14000 service number to initiate a call.

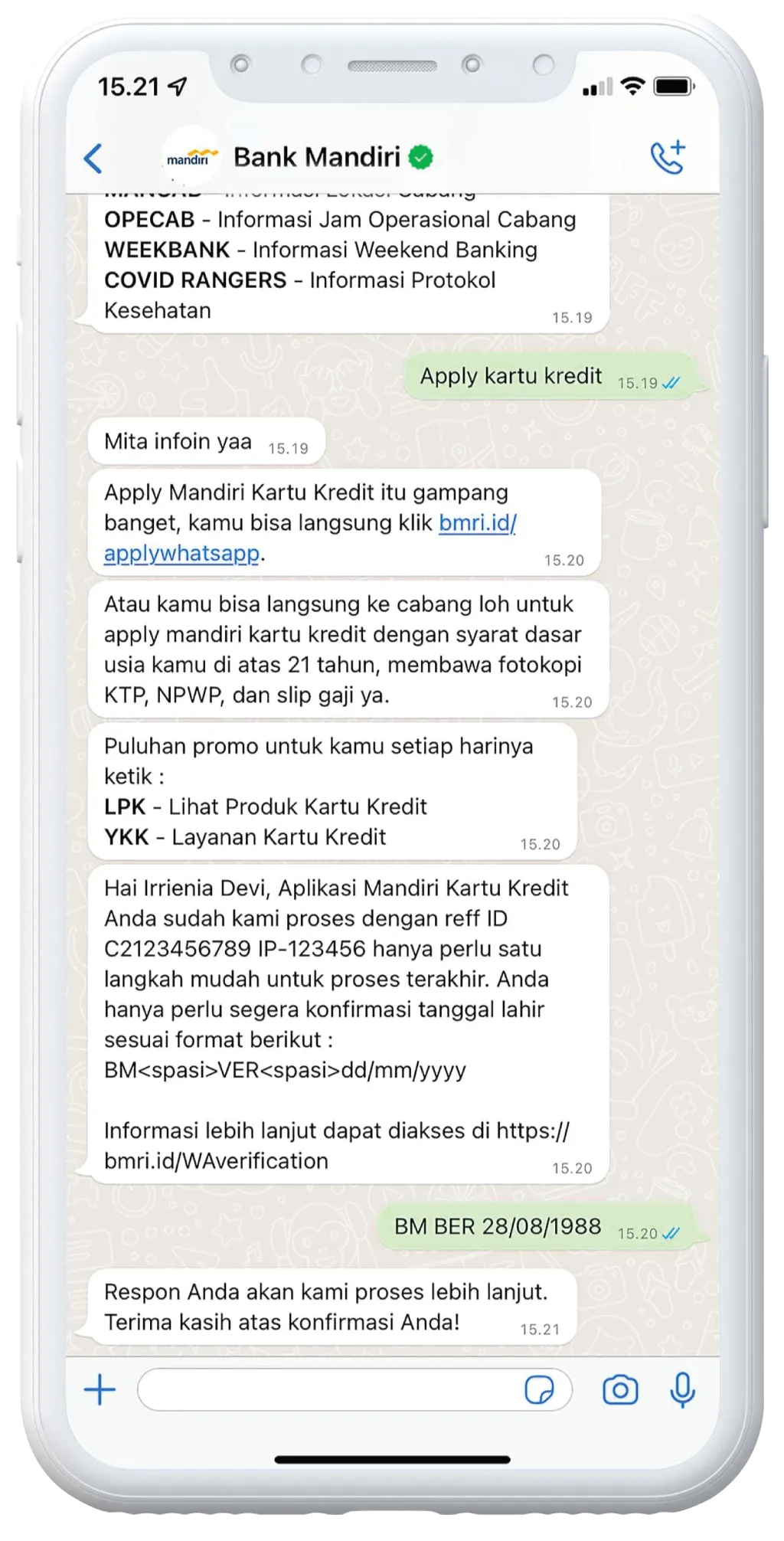

To streamline the credit card application process, Bank Mandiri focused on simplifying the verification process. Customers would receive push notifications asking them to verify their identities by replying directly through WhatsApp.

To confirm their identities, customers would receive a unique code—personalized to include their birth date—they could use to verify their submitted application.

With this crucial part of the application process now automated, calls to live agents decreased and application approvals started to grow.

“By increasing the number of push notifications through automation, Bank Mandiri can issue more credit cards to qualified customers and in turn increase revenue from credit card purchases,” said Bank Mandiri Senior Vice President Sunarto Xie.

The Success: A swift increase in conversion rates and income

Over the course of 2021, WhatsApp became Bank Mandiri’s #1 channel for conversions, quickly surpassing SMS, telesales, call center, website, and mobile app conversions in volume.

WhatsApp is currently responsible for 37% of all conversions for Bank Mandiri. The streamlining of two critical processes via WhatsApp (installment plan signups and credit card applications) led to a 42% increase in net margin interest income through installment plans and a 56% increase in credit card applicants responding to verification notifications.

“By integrating automated workflows, WhatsApp has become the number one channel that supports Bank Mandiri’s objectives in ways that meet our customers’ needs, deflect inquiries from live agents, and increase revenue by facilitating more new credit card applications and changes to existing customers’ accounts,” Xie said.

In 2021, WhatsApp drove the highest volume of conversions for opted-in credit card customers at a rate of almost 43%. The next highest-converting channel was the call center, with a 5% success rate.1

The Future: A steadfast dedication to elevating digital banking experiences

Bank Mandiri is unwavering in its mission to continue to establish progressive digital banking business models in Indonesia that offer customers automated, simple, quick, and reliable banking services and products.

WhatsApp Business Platform will continue to be the bank’s main partner on this journey.

Moving forward, Bank Mandiri looks to grow the uses of their WhatsApp channel to automate and improve:

- Credit card activation

- Credit card upgrades

- Card delivery services

- Payment due alerts

- Proactive and personalized notifications

“WhatsApp Business Platform provides opportunities for the banking and financial services industry…by enabling convenient digital customer services while improving business performance. In the future, Bank Mandiri will further optimize this service to meet customer needs.” Xie said.

Learn more about how WhatsApp Business Platform can create better customer experiences and drive growth for your business, too. To read the full case study, click here.