Business Platform

Agibank

Engage hard-to-reach customers with personal messaging to increase financial services sales

Business Platform

Engage hard-to-reach customers with personal messaging to increase financial services sales

message open rates in WhatsApp compared to email or SMS

ROI compared to email or SMS

of all credit renewals came through WhatsApp in less than a year

reduction in churn attributable to WhatsApp

*All results are self-reported and not identifiably repeatable. Generally expected individual results will differ.

Over 20 years, Agibank has evolved from one of the largest payroll providers in Brazil to a commercial bank guided by a mission to ensure that all Brazilians have access to financial services, regardless of their status or income. Agibank is a leading neobank known for building strong personal relationships with customers while generating high profitability and providing tailored assistance for low-income customers who might not be tech savvy.

Agibank has a mission to make financial services accessible to all Brazilians, including low-income earners who are often neglected by other banks. The bank needed a communications channel to engage and digitalize non tech-savvy low income customers who don’t use email, the Agibank app, or check SMS regularly with personal offers and messaging.

Personalized messaging from “Gi” resulted in higher engagement and increased credit renewals

For over 20 years, Agibank has been dedicated to making banking, credit, and financial services accessible to all people across Brazil – including low-income customers often overlooked by other banks.

The bank emphasizes building relationships with customers by reaching them where they are, from almost 1000 physical hubs across Brazil to a powerful digital app called Agi. While roughly half of Agibank customers adopted the Agi app, the bank’s survey of the remaining customers – mainly older and less tech savvy users – indicated a preference for a more familiar communications channel. The bank knew that WhatsApp was widely popular across Brazil.

Seeing lower open rates for messages sent through email and SMS, Agibank worked with a third-party provider to develop a customer engagement channel using WhatsApp Business Platform. Reaching customers who might not have access to email or open texts regularly with more personal messaging required sharper data gathering abilities than the niche provider could offer. With Agibank already using Salesforce Marketing Cloud for customer engagement, the bank partnered with Salesforce to create a WhatsApp marketing channel and leverage the native integration on Marketing Cloud.

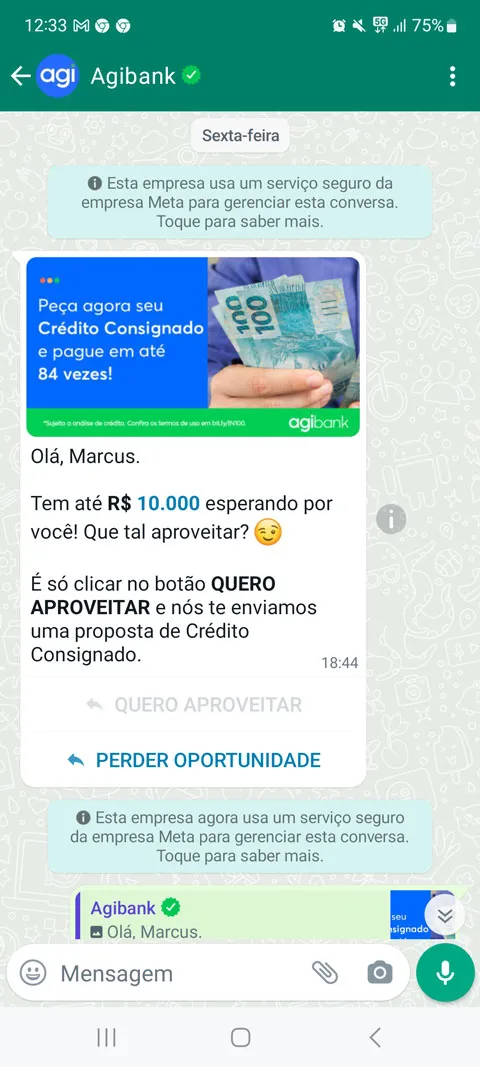

Using integrations between WhatsApp and Salesforce Marketing Cloud, Agibank teams can develop and approve content in Marketing Cloud and push it out seamlessly via WhatsApp. For more effective messaging and segmentation, the team can access data stored within the bank’s customer relationship management platform in Salesforce. The bank piloted its new WhatsApp channel with a campaign targeting customers at the end of a credit program.

Using “Gi,” a virtual assistant built into WhatsApp, the bank sends customers a message asking if they want to renew their credit with a simple yes or no via a WhatsApp button. Customers who answer yes receive a link inviting them to complete a biometric authentication process before they’re routed back to WhatsApp, where they can complete the renewal application process.

“Delivering easy-to-understand messages over a channel customers trust increased engagement, with message open rates in WhatsApp 10 times higher than email or SMS. In only eight months, 20 percent of all credit renewals came through WhatsApp,” says Matheus Girardi, Chief Customer Officer, Agibank.

Chief Customer Officer, Agibank

The partnership between Agibank, Meta, and Salesforce allowed the bank to quickly set up marketing campaigns in WhatsApp without taking on the time or expense of relying on third-party providers. While having insights into customer data right at their fingertips, the bank’s marketing teams also benefit from a faster, code-free process of creating and sending messages to large volumes of customers.

“The native integration between WhatsApp and the bank’s digital marketing stack helps Agibank reach customers with the right message at the right time,” says Isabela Rossi, Senior Product Marketing Manager, Salesforce LatAm. “By adding WhatsApp as a key part of its omnichannel outreach, Agibank makes banking available to everyone, regardless of their experience with technology.”

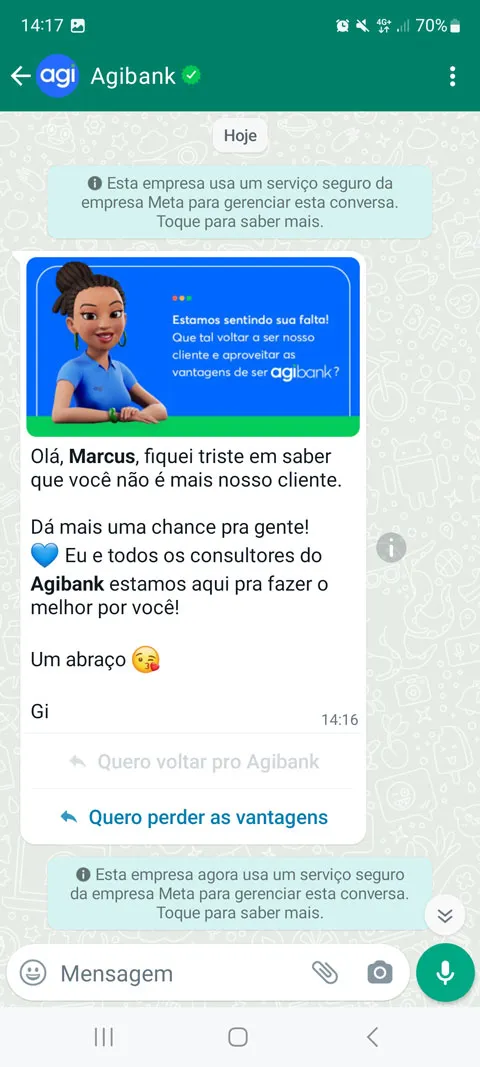

With Gi as the face of Agibank’s WhatsApp channel, the bank offers customers a more consultative experience of renewing credit, from the personal invitation to re-apply to a streamlined application process. As more customers engage with Gi, the Agibank team obtains richer data to use in creating campaigns that excite Brazilians from all backgrounds about participating in banking.

“Using WhatsApp, we reduced churn rates by 25 percent, showing clear enthusiasm from customers who traditionally didn’t engage with us through email or text. The targeted campaign we developed via WhatsApp and Salesforce Marketing Cloud had 25 times the ROI than campaigns over other channels,” says Girardi.

Inspired by their success, the Agibank team is looking to develop an onboarding experience for new customers through WhatsApp, including potentially sending multimedia welcome messages. Agibank looks to expand data gathering abilities in WhatsApp to create even more responsive messaging. There are also plans to develop a customer service component on WhatsApp.

“Building customer loyalty is essential to our mission of ensuring that no one is ever left behind in accessing key financial services. Adopting WhatsApp has helped us fulfill that mission with every message,” says Girardi.

Agibank used WhatsApp Salesforce integration to cut churn by 25% through targeted campaigns

When Agibank develops a communications channel in WhatsApp, the bank engages customers who aren’t traditionally email or SMS users with a credit renewal campaign that drives high message open rates and reduces churn.

*All results are self-reported and not identifiably repeatable. Generally expected individual results will differ.

Chief Customer Officer, Agibank

WhatsApp Business प्लेटफ़ॉर्म के पार्टनर, कस्टमर के साथ जुड़ने के लिए WhatsApp को एक चैनल के तौर पर इस्तेमाल करने में आपकी मदद कर सकते हैं. इसके लिए आप प्लान बनाने, उस पर काम करने और इंटीग्रेट करने में उनकी मदद पा सकते हैं.