Business Platform

Banco Mercantil

Growing customer engagement with ads that click to WhatsApp, messages on WhatsApp and WhatsApp Business Platform

Business Platform

Growing customer engagement with ads that click to WhatsApp, messages on WhatsApp and WhatsApp Business Platform

Of all customers who started a conversation on WhatsApp acquired at least one credit product*

Higher conversion rate from marketing messages on WhatsApp compared to SMS messages (33% conversion rate)*

Increase in average loan repurchase rate per customer during a 12-month period*

Sales share attributed to WhatsApp*

*Results are self-reported and not identifiably repeatable. Generally expected individual results will differ.

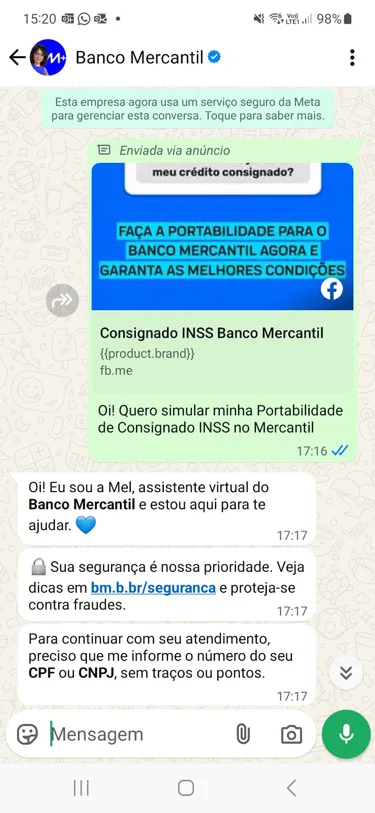

Banco Mercantil targets its financial services to Brazilian customers ages 50 and older, with a specialty in pension loans and Brazilian National Social Security Institute benefit payments. To make its services more accessible for its primary audience, Banco Mercantil is accessible to customers both through its Mercantil app and on WhatsApp.

The bank views WhatsApp Business Platform as an ideal customer engagement solution given its wide adoption in Brazil, and because it enables customers to access its services with or without a bank account. Banco Mercantil has developed a streamlined approach to engaging customers on WhatsApp that utilizes ads that click to WhatsApp, WhatsApp Business Platform and a variety of WhatsApp message templates, to boost sales of its credit offerings with minimal friction.

Lucas Kubiaki

Director of Digital and Products, Banco Mercantil

Banco Mercantil’s marketing and customer communication strategy is designed to onboard customers to its financial ecosystem on WhatsApp. Banco Mercantil targets potential customers with ads that click to WhatsApp. After clicking, people are directed to an automated conversation with Mel, the bank’s digital banking assistant on WhatsApp. Mel walks them through every step that’s required to take out a loan, integrating seamlessly with credit bureaus and government institutions as part of its verification process. Once a customer accepts an offer from the bank and provides additional information, Banco Mercantil runs an anti-fraud check entirely within WhatsApp Business Platform.

After the initial conversation with Mel, customers are retargeted with marketing messages on WhatsApp promoting new offers or reminding them about offers they abandoned in their cart. Utility messages on WhatsApp are sent to inform applicants about where they are in the approval journey and share important non-marketing communications from the bank. And service messages on WhatsApp are used anytime a customer messages Banco Mercantil directly on WhatsApp to inquire about getting a loan or other service.

Banco Mercantil measured a year of performance data (June 2024–June 2025) and attributed high conversion rates and high return purchases to its unified financial ecosystem powered by WhatsApp Business Platform, including:

*Results are self-reported and not identifiably repeatable. Generally expected individual results will differ.

Munir Ruffo

Head of WhatsApp, Banco Mercantil

WhatsApp Business Platform partners can help you plan, build and integrate WhatsApp as a channel to connect with your customers.