Business Platform

LAFISE Bank

Providing fast, more secure customer service to boost customer satisfaction scores and attract new customers

Business Platform

Providing fast, more secure customer service to boost customer satisfaction scores and attract new customers

decrease in call center volumes attributable to WhatsApp

customer satisfaction scores for service through WhatsApp and live agent

growth in new customers attributable to WhatsApp

increase in sales of new products linked to WhatsApp

*Results are unique and are provided by the featured business. Success story results will vary, as they depend on a variety of factors.

LAFISE Bank is the second largest bank in Nicaragua, and an award-winning financial institution recognized by Euromoney as the “Best Bank in Nicaragua” and “Best Bank for SMEs in Latin America.” The bank provides a range of financial services for its customers with a focus on international banking across 11 countries.

During the pandemic, LAFISE Bank experienced a surge in call center volumes and needed a scalable communications channel to provide faster, highly secure, and efficient service to help customers quickly process remittances. Additionally, LAFISE wanted to expand their range of services.

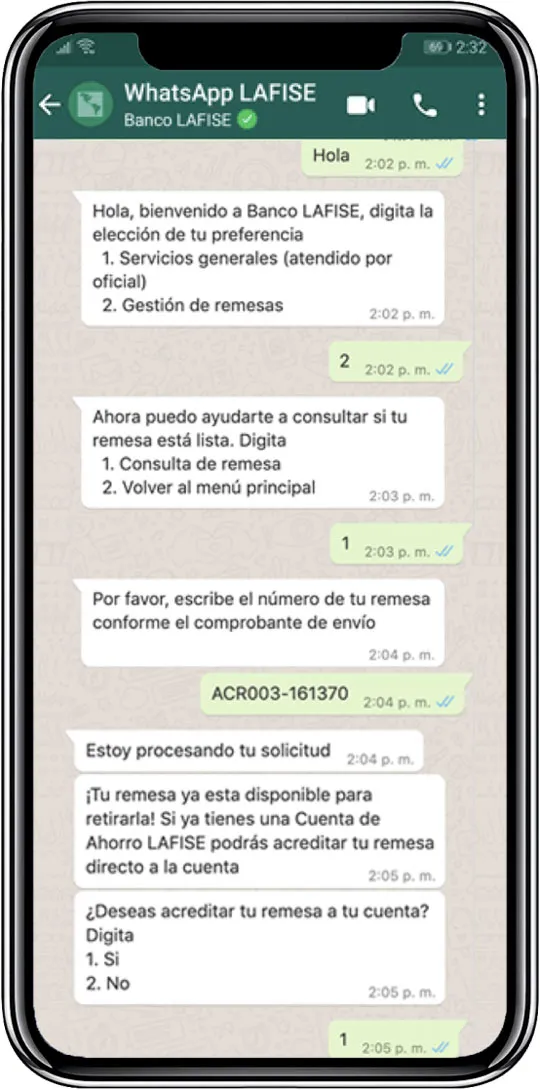

Virtual assistant allows customers to easily check on the status of their remittance

As one of Nicaragua’s leading financial institutions, LAFISE Bank is trusted by customers around the world to help them support their loved ones by enabling quick transferring and remittance processing in the region.

Traditionally, customers needed to physically visit banking institutions to conduct different transactions; however, social distancing implemented during the pandemic made these in-person services inaccessible. Customers flooded the customer service channels in high volumes, which increased waiting times and affected overall satisfaction.

LAFISE sought a highly secure, reliable communications channel that would meet their needs to scale with customer demand. Partnering with Aldeamo, a communications platform-as-a-service company, the bank developed a virtual assistant on the WhatsApp Business Platform.

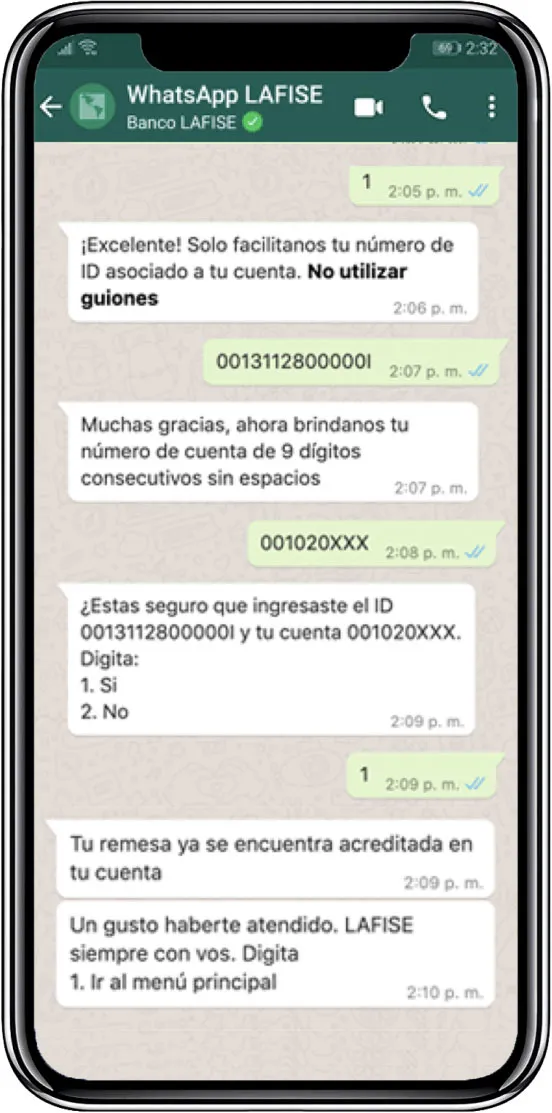

Using the virtual assistant, customers can easily choose from a variety of options within a user-friendly WhatsApp menu. Functionalities include checking on the status of transactions and wires, while also having the ability to complete transfers to their accounts. The virtual assistant matches the unique money transfer ID number to a customer’s national ID, and securely verifies the data to ensure the transaction completes to the right account.

“Accessing and transferring money from anywhere is an urgent matter for most people and with WhatsApp, they can start the process right away. Our customer average wait times through WhatsApp has improved by 90%,” says Manuel Carrillo, ITD Remittances Manager, LAFISE Bank. “As more customers complete the remittance process over WhatsApp, our call center volumes have decreased by 35%.”

ITD Remittances Manager, LAFISE Bank

LAFISE also included an option to open a bank account through WhatsApp with the intention to help customers avoid transaction fees with third party agencies. The bank has observed that customers have responded positively to the additional range of services offered. “We’ve dramatically increased customer satisfaction to 93% through our virtual assistant. Our combined approach with the live agent has performed even better, achieving a 100% satisfaction score, in addition to an estimated 20% growth in new customers,” says Carrillo.

As an early adopter of WhatsApp among banks in Nicaragua, LAFISE earned a Green Tick Verification to reassure customers that they’re engaging with the bank's official business account.

“The Green Tick Verification assures LAFISE customers that their transactions are just as secure as traditional in-person customer service, while benefiting from the speed and convenience of interacting over WhatsApp,” says Ana Cadillo Hasbun, Marketing Manager, Aldeamo.

Inspired by their success using WhatsApp to help customers handle remittances and open new accounts, the bank has expanded its services through the virtual assistant. Enhanced capabilities include checking balances and adding lines of credit, as well as other banking services.

“Our transactions through WhatsApp have improved by 48% and our new product sales have increased by 25%,” says Carrillo. “When we’ve surveyed customers, 55% indicate that messaging over WhatsApp makes them feel more connected to us.”

There are plans to expand access to the virtual assistant in WhatsApp, add options for generating credit card PIN numbers as well as purchasing fraud protection services over WhatsApp regionwide, where LAFISE Bank offers financial solutions beyond borders.

Virtual assistant provides secure account validation

LAFISE Bank develops a virtual assistant through WhatsApp to decrease call center volumes, improve customer satisfaction, and generate growth in new customers and sales.

*Results are unique and are provided by the featured business. Success story results will vary, as they depend on a variety of factors.

WhatsApp Business Platform partners can help you plan, build and integrate WhatsApp as a channel to connect with your customers.