Business Platform

Banco Bolivariano

Engaging digitally savvy customers while boosting sales and reducing call center volumes

Business Platform

Engaging digitally savvy customers while boosting sales and reducing call center volumes

of all inquiries handled only via WhatsApp

of credit card additional services purchased through WhatsApp

decrease in call center volumes attributable to WhatsApp

of customers prefer WhatsApp to other digital channels

*Results are unique and are provided by the featured business. Success story results will vary, as they depend on a variety of factors.

Banco Bolivariano is one of the largest financial institutions in Ecuador and the country’s first bank to launch online banking. The bank provides comprehensive financial services for corporate and personal banking customers.

As a forerunner in online banking within Ecuador, Banco Bolivariano looked for a faster, more customized communication channel to meet the needs of digitally savvy customers while decreasing call center volumes and promoting a key credit card protection service.

Chatbot “Avi” offers options to assist customers with banking needs

Its success at applying modern sensibilities to more traditional banking services has made Banco Bolivariano one of Ecuador’s largest financial institutions. As the country’s first major bank to launch internet banking, Banco Bolivariano always searches for new ways to improve digital banking. While the bank engaged with customers over its website and web portals, mobile app, SMS, email, and social media, increasingly digitally savvy customers demanded even faster, more personalized online banking options.

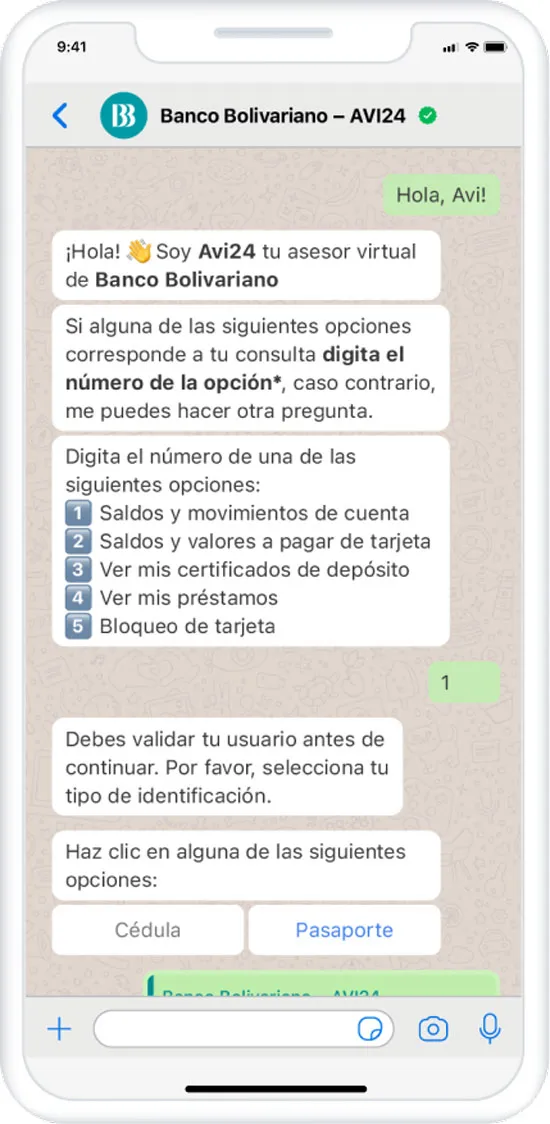

To expand its robust omnichannel approach, Banco Bolivariano looked to WhatsApp, a popular app in Ecuador. Working with AI solutions provider Aivo, the bank set up a customer communications channel powered by the WhatsApp Business Platform. When customers contact the bank over WhatsApp, they’re greeted by an automated digital assistant called “Avi”. Through Avi, customers are able to select from a menu of frequently asked questions like branch hours and locations, or more specific inquiries such as account balances.

The versatile Avi also lets customers enter their questions directly into a chat, expanding the kinds of information customers can receive – including consultations about loans or investments, based on their current account data. If a customer is unable to resolve their inquiry over Avi, they can jump into a chat with a live agent.

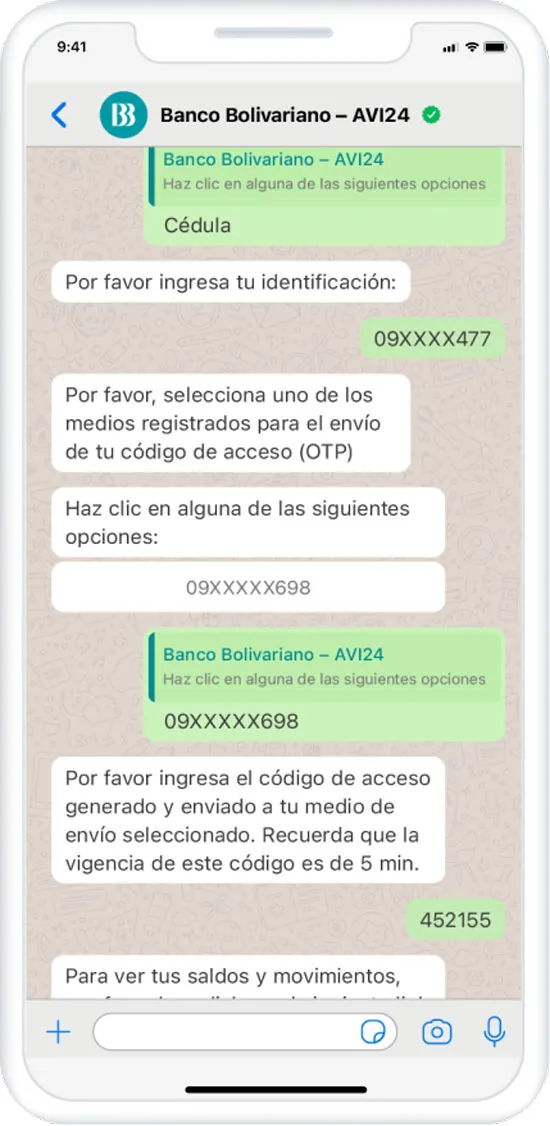

Interactions are immediately more efficient since agents can access all relevant details from the initial conversation without asking the customer to repeat themselves. Teams specially trained in WhatsApp, including multimedia capabilities like images and video, can typically address an issue up to 27 percent faster than counterparts over the phone.

“Roughly 98 percent of all customer inquiries are resolved through WhatsApp without escalating to an agent. Now, 70 percent of our customers prefer WhatsApp to other digital channels, and they give it the highest satisfaction rates of any channel,” says Kyra Arcia, Head of Marketing and Innovation. “As more people connect over WhatsApp, call center volumes are down by 46 percent and agents can focus on the most complex cases.”

Head of Marketing and Innovation, Banco Bolivariano

Before Banco Bolivariano implemented Avi, customers frequently contacted the call center to activate or deactivate their credit cards for international travel. Now, they can simply send a chat through WhatsApp before departing – or even while they’re abroad. Making it easier for customers to protect their credit cards is part of the bank’s commitment to quality, secure online banking.

“The same spirit of service that made Banco Bolivariano one of Ecuador’s leading banks has driven them to become the first Ecuadorian bank to receive WhatsApp Green Tick Verification,” explains Lola Rainero, Content Marketing Manager, Aivo. “That verification gives customers peace of mind that they’re engaging with the real Banco Bolivariano. Every interaction over WhatsApp comes with the banking security they expect.”

Across all digital channels, the bank promotes services and complementary products that deliver additional value to the bank’s customers. With WhatsApp emerging as the bank’s most popular communications channel, Banco Bolivariano started encouraging customers to purchase additional services after checking their account balances through Avi.

“Customers appreciate the organic flow of interacting in WhatsApp, making them more receptive to offers. Currently 56 percent of customers engaging through WhatsApp express interest in additional services, compared to only 23 percent over the phone,” says Arcia. “With a flexible, streamlined channel in WhatsApp, we not only see time and cost savings in customer care, but actual increase in revenue.”

According to Arcia, Banco Bolivariano will continue to explore the customer care and sales capabilities within Avi and develop new services through WhatsApp: “We’ve always been digital banking pioneers and with WhatsApp, we’re expanding into new frontiers of customer service.”

Secure authentication when accessing account information

When Banco Bolivariano builds a digital assistant in WhatsApp, it delivers high-quality, effective customer service while reducing call center volumes and boosting sales.

*Results are unique and are provided by the featured business. Success story results will vary, as they depend on a variety of factors.

WhatsApp Business Platform partners can help you plan, build and integrate WhatsApp as a channel to connect with your customers.